Judgemental IFRS standards

Key Points Research suggests that several IFRS standards involve significant calculations, such as valuation and share-based payments, impacting financial reporting accuracy. It seems likely that standards like IFRS 2 (Share-based Payment) and IFRS 9 (Financial Instruments) require complex fair value and impairment calculations. The evidence leans toward IFRS 16 (Leases) and IFRS 17 (Insurance Contracts) having detailed numerical computations for liabilities and contract measurements. IFRS Standards with Significant Calculations The following IFRS standards involve significant numerical computations, similar to those for valuation and share-based payments:

Read more

Judgemental IFRS standards

Key Points Research suggests that several IFRS standards involve significant calculations, such as valuation and share-based payments, impacting financial reporting accuracy. It seems likely that standards like IFRS 2 (Share-based Payment) and IFRS 9 (Financial Instruments) require complex fair value and impairment calculations. The evidence leans toward IFRS 16 (Leases) and IFRS 17 (Insurance Contracts) having detailed numerical computations for liabilities and contract measurements. IFRS Standards with Significant Calculations The following IFRS standards involve significant numerical computations, similar to those for valuation and share-based payments:

Read more

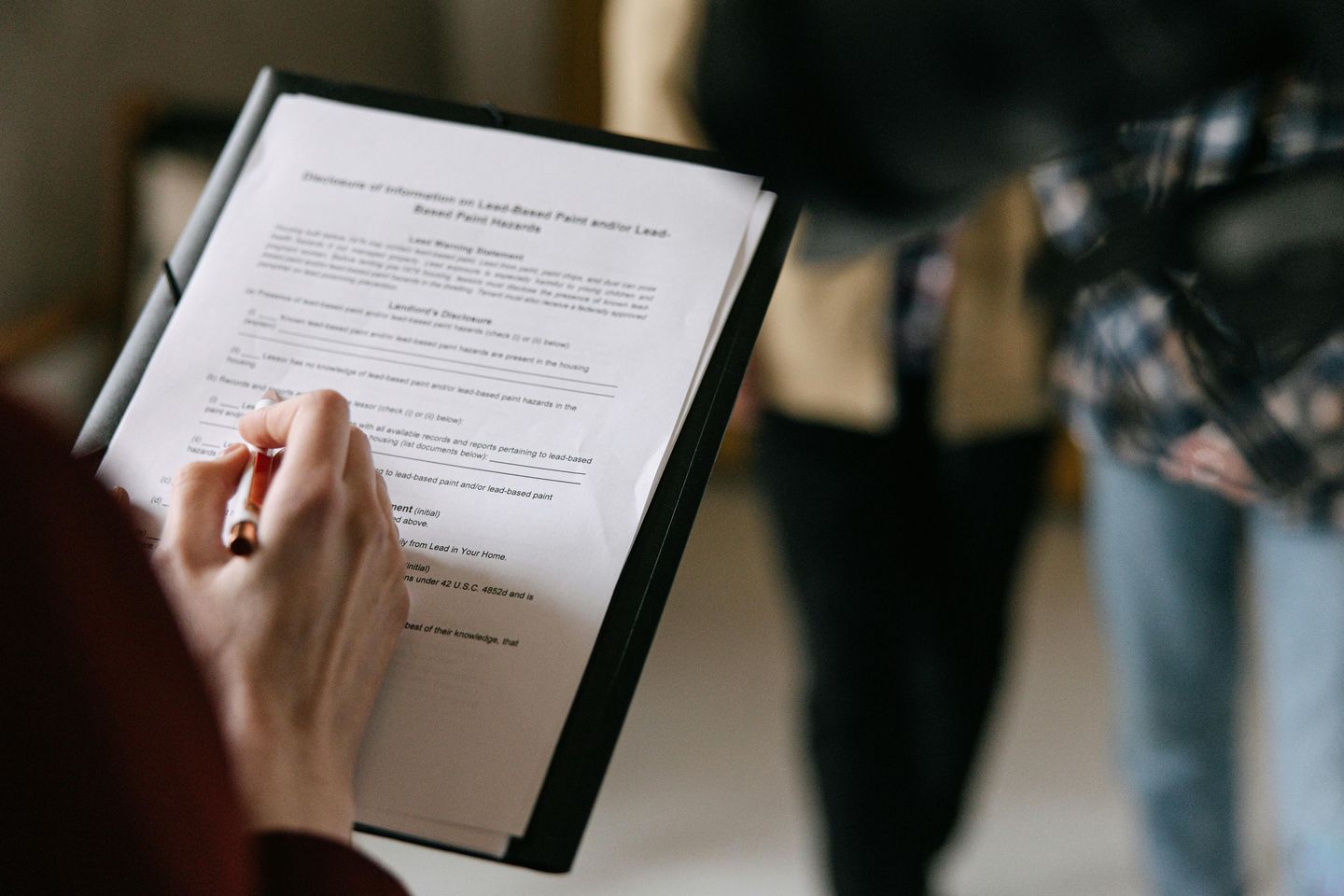

Lease Accounting

Key Points Lease accounting under IFRS, specifically IFRS 16, requires recognizing most leases on the balance sheet, impacting financial reporting. Key calculations involve measuring lease liabilities and right-of-use assets, using inputs like future payments and discount rates. The evidence leans toward a comprehensive list of inputs, including payment details, costs, and asset life, though complexity arises with variable terms. Overview of Lease Accounting Under IFRS Lease accounting under IFRS is governed by IFRS 16, effective since 2019, which changed how companies report leases. It requires lessees to recognize assets and liabilities for leases over 12 months, unless the asset is of low value, moving away from previous off-balance sheet treatment for operating leases. This shift aims for transparency, showing lease obligations clearly on financial statements.

Read more